The Ultimate IRS Tax Resolution Software

for CPAs, EAs, and Tax Attorneys

Version 8.0

What's new at PitBullTax?

Upgrade Your Email Game with AI-Powered Assistance

Elevate your email experience with our AI companion, primed to streamline your message composition and letter writing tasks.

Access Expert Guidance with IRM AI Companion

Introducing our AI companion tailored to provide quick and accurate responses to your inquiries about the Internal Revenue Manual (IRM).

Tailor professional letters with AI Companion

This cutting-edge integration streamlines the creation and edition of various types of letters for tax resolution. Revolutionizes how tax professionals manage client communication.

New State POAs

State Power of Attorney Forms for California, Illinois, New Jersey, Colorado, Florida, Texas, North Carolina and New York are available in PitBullTax Software.

New IRS Transcripts Report

Tax Return & Trust Fund Report / Form 941

AI Explanation for IRS Forms

Generate detailed, compelling explanations of tax situations in minutes with AI, simplifying complex IRS form narratives and potentially helping resolve client cases.

Client Questionnaire Reminders (SMS & Email)

Effortlessly send SMS or email reminders to clients, ensuring they promptly provide the information needed for their case.

Incoming & Outgoing Email Correspondence with AI Assistant

Effortlessly manage client emails by connecting multiple email accounts to PitBullTax Software.

Customizable Transcript Alerts with AI Assistant

Receive Daily Email Alerts on important changes on your clients' IRS accounts.

How To Make Money With IRS Transcripts

See How PitBullTax Can Help You Automate The IRS Transcript Analysis Process & Identify Client IRS Issues Months Ahead Of Time

Watch Now!

PitBullTax Software Version 8.0: The Future of Tax Resolution

Discover powerful new features enhancing efficiency, automation, and client communication for tax resolution professionals.

Watch Now!

Learn About PitBullTax in just 2 minutes!

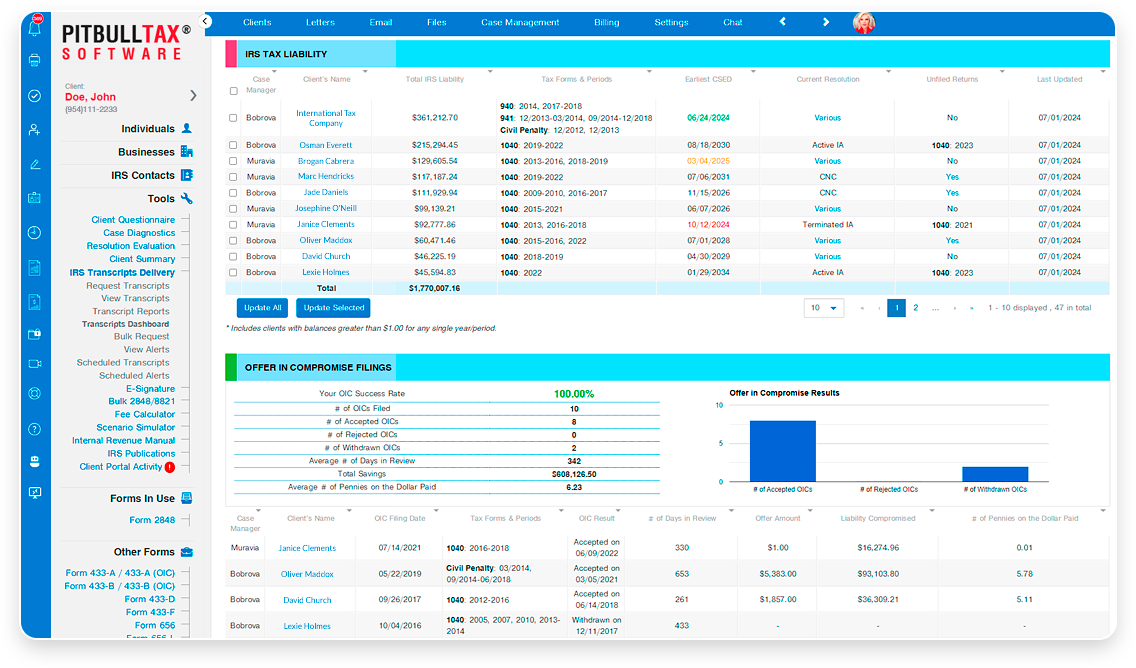

THE ALL-IN-ONE SOLUTION for Running a Successful Tax Resolution Business

Check Video PresentaionThe Nation’s Leading Tax Resolution Software

IRS Transcript Delivery and Reporting with Automatic Daily Alerts

Effortlessly download your clients' IRS transcripts and let our powerful software do the work for you. Instantly analyze data, generate insightful reports, and get notified of account changes up to six months in advance - keeping you ahead of the game.

Case Management and Billing

Control your clients’ cases and track your billing situation. Supplement it with the Payment Processing add-on and you will also be able to charge your fees through the software.

Integrated IRS Forms and Supporting Schedules

See with your own eyes how easy it is to represent a client when your tax resolution software auto populates most of the forms for you.

Client Portal

Share files with your clients and streamline the document exchange process between tax practitioner and a client. Communicate with your clients via a built-in chat messenger included as a part of the Client Portal.

Step by Step Workflow

Not sure how to work the case? Use this software feature to guide you through a logical step by step approach on how to analyze, create and prepare a tax resolution case.

Resolution Evaluation

Quickly evaluate if your client is a likely candidate for an Offer in Compromise, Installment Agreement or Currently Not Collective status.

I can do so many more cases per year just because of the speed and efficiency of the software.

One resolution case per year pays for my whole annual Pitbull license and then some!

Katharine LaBoda

Louise Hartford

Their technical support is outstanding, our clients love the IRS transcript report that we are able to provide after tapping into the IRS computers and also the ease of transferring information from one IRS form to another is a huge time saver!

Highly recommended!

Patrick Noone

Give it a try—you won't be disappointed!

Norris Lozano